At the BRICS 2024 Summit, Xi Jinping revealed a transformative payment system, aiming for economic autonomy. This announcement marks a significant milestone for the bloc.

By introducing the BRICS Pay system, the alliance seeks to reduce dependency on Western financial frameworks, showcasing their commitment to a multipolar world.

Significance of the New BRICS Payment System

The announcement of the BRICS Pay system marks a significant shift in the global financial landscape. This initiative underscores an ambitious attempt by the bloc to attain economic independence from Western dominance. By doing so, BRICS aims to forge a path towards monetary sovereignty for its member countries. The new system is a testament to the bloc’s growing influence and its commitment to promoting a multipolar financial world.

A Shift Towards De-dollarization

BRICS’s move towards de-dollarization is evident in its efforts to reduce dependency on the US dollar. This strategy aims to mitigate the potential risks associated with dollar reliance. The introduction of the BRICS Pay system represents a critical step in establishing an alternative financial framework, one that favours the use of member countries’ currencies.

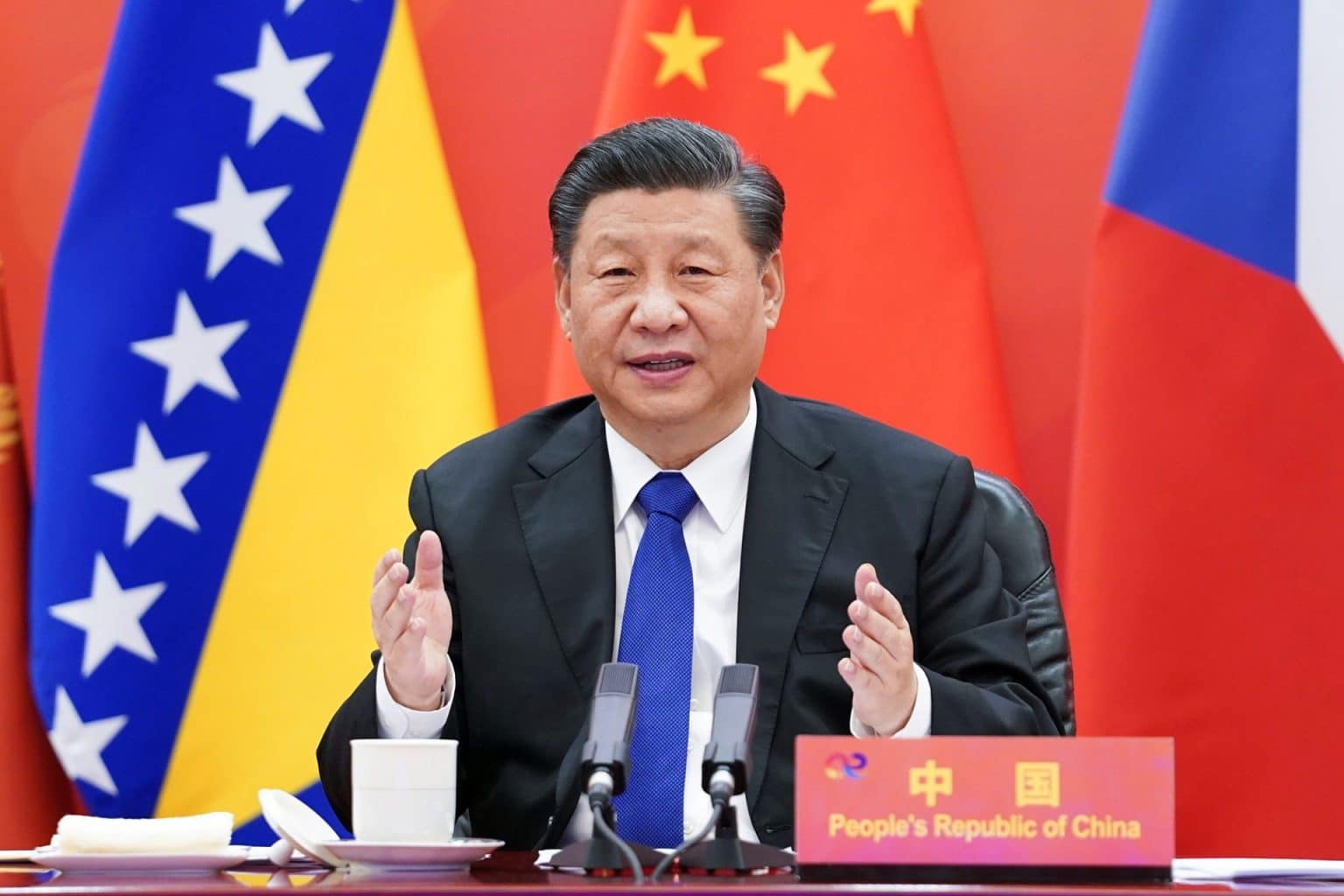

Xi Jinping’s statement during the summit highlighted the necessity of reforming the global financial architecture. His speech resonated with the bloc’s determination to challenge the existing international monetary norms, advocating for a system that reflects the changing economic power dynamics.

Demonstration of the BRICS Pay System

In a precursor to the summit, the BRICS Business Forum in Moscow showcased the innovative payment platform. Attendees were introduced to the BRICS Pay demo card, offering a tangible glimpse into the future of transactions within the bloc. This early demonstration has piqued interest and expectations among financial experts worldwide.

The demo illustrates the system’s practicality, showing its potential to streamline transactions and enhance economic cooperation among BRICS nations. The forum served as a platform for demonstrating the potential seamless integration of this new system into everyday financial activities. The audience’s feedback could play a pivotal role in refining the final product.

Strategic Implications for Member Nations

For member nations, the adoption of the BRICS Pay system promises increased economic collaboration and reduced foreign exchange risks. By facilitating use of local currencies, the system is set to boost intra-BRICS trade and reduce transaction costs for businesses. This has the potential to strengthen economic ties within the bloc.

The strategic shift is also expected to elevate the global standing of BRICS countries. It positions them as pioneers in developing a robust alternative to established Western financial infrastructures, like SWIFT, and enhances their leverage in international economic negotiations.

Reactions from the International Community

The international community has been closely monitoring BRICS’s financial innovations. Western leaders, in particular, have expressed cautious observations about the bloc’s growing economic influence. Concerns about the impact of such systems on existing financial structures were raised amidst discussions on global economic stability.

Social media platforms have been abuzz with discussions about the potential implications of the BRICS Pay system. Analysts have noted that this could herald a new era in global finance, challenging long-standing economic conventions. The system’s success could spur similar initiatives among other emerging economies.

Many experts believe that the new system could eventually become a blueprint for other regions aiming to enhance monetary independence. However, the challenges of integrating such a comprehensive system across diverse economies remain a focal point of ongoing debates among economists.

Challenges Ahead for the BRICS Pay System

Despite its promising prospects, the BRICS Pay system faces significant hurdles. Technological integration across all member countries could prove challenging, requiring substantial infrastructure investment and policy alignment. Ensuring cybersecurity will be paramount to safeguarding the system’s integrity.

The potential need for regulatory harmonisation among member states poses another challenge. Establishing a unified regulatory framework will be critical to the system’s success and long-term sustainability. Aspects such as cross-border transaction regulations, data privacy, and technological standards require careful consideration.

Moreover, addressing the stark economic disparities among BRICS nations will be essential to ensure equitable benefits from the system. This will require collaborative strategies and policies that promote inclusive growth and financial participation across the bloc.

Prospects for Global Financial Reform

The emergence of the BRICS Pay system signals a broader trend towards financial diversification. It represents a tangible effort to reform the established financial order and could inspire other multinational alliances to pursue similar initiatives.

If successful, the system could significantly alter global financial dynamics, providing a credible alternative to dominant Western financial models. It highlights a growing appetite among emerging economies for more control over their monetary policies. Such developments may ultimately contribute to a more balanced global economic landscape.

The unveiling of the BRICS Pay system is a pivotal moment in global finance, suggesting a shift towards more diversified financial systems. As BRICS nations move forward with this ambitious project, the world watches closely, anticipating the potential reshaping of economic power dynamics. Whether it can overcome its challenges will determine its role in the future financial order.